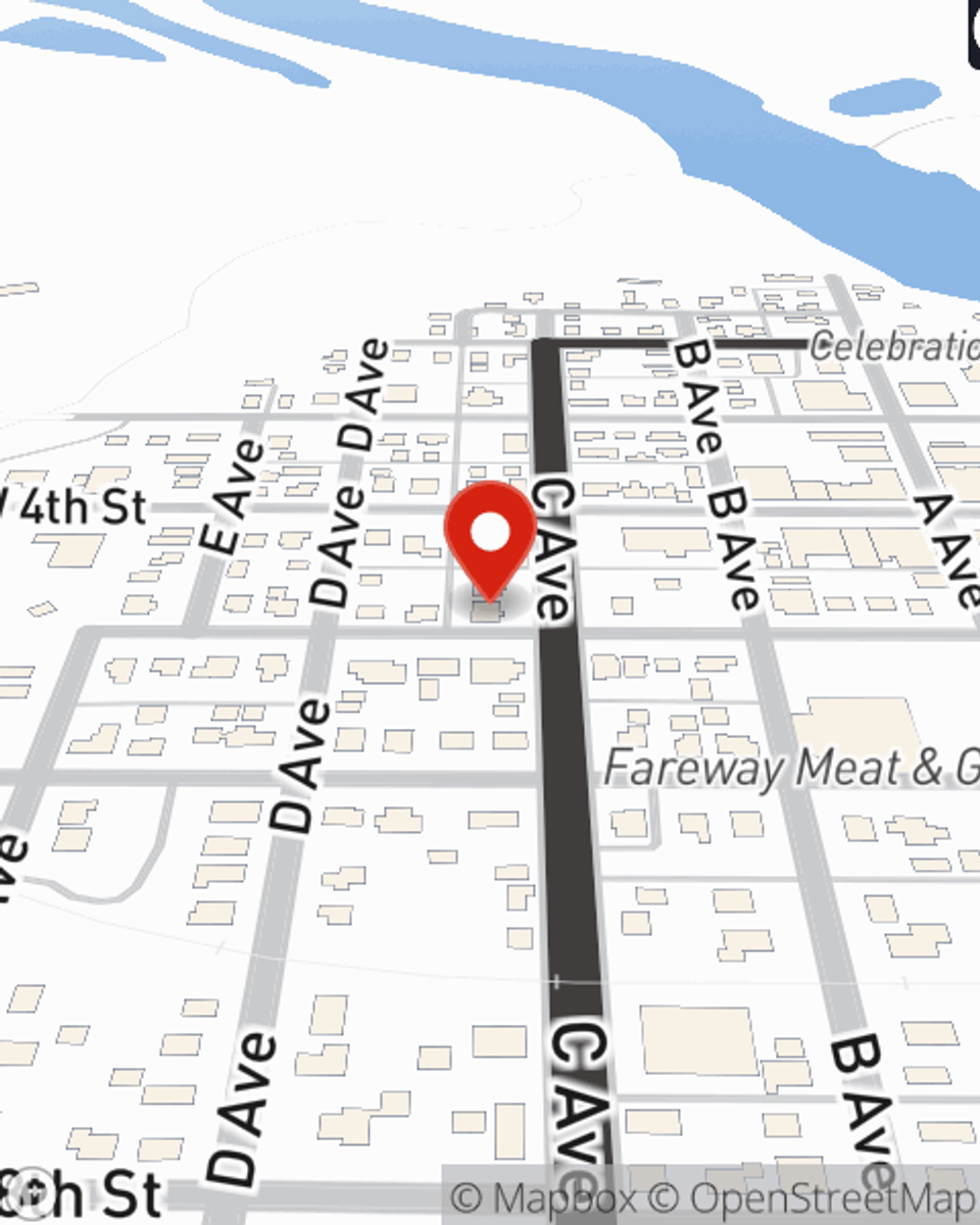

Business Insurance in and around Vinton

One of Vinton’s top choices for small business insurance.

Almost 100 years of helping small businesses

- Vinton

- Benton County

- Urbana

- Shellsburg

- Dysart

- La Porte City

- Iowa

- Center Point

- Linn County

- Black Hawk County

- Buchanan County

- Walker

- Van Horne

- Atkins

- Blairstown

- Belle Plaine

- Garrison

Help Prepare Your Business For The Unexpected.

Being a business owner is about more than being your own boss. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, extra liability coverage and worker's compensation for your employees.

One of Vinton’s top choices for small business insurance.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

At State Farm, apply for the excellent coverage you may need for your business, whether it's a gift shop, a pet store or an ice cream shop. Agent John Leonard is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Reach out agent John Leonard to consider your small business coverage options today.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

John Leonard

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.